Terms & Conditions

General terms of use

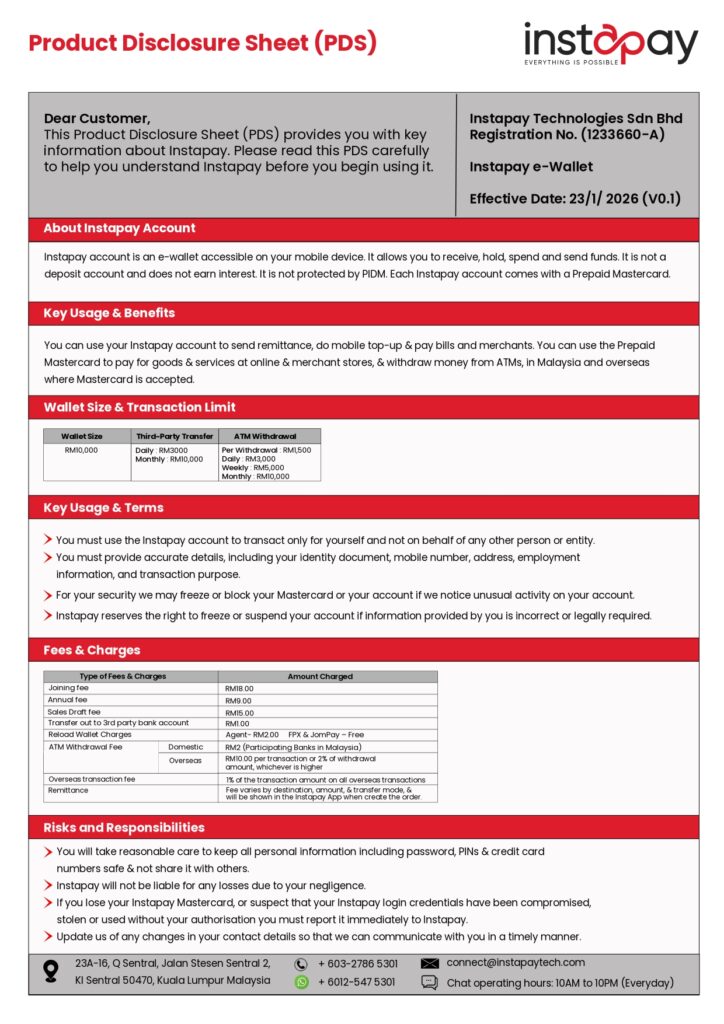

1.The terms and conditions set out in this General Terms of Use (“Terms”) apply to the use of the Site, App and Services.

2.The Terms govern all users of the Site, App and/or Services (collectively “Users” and each a “User”) and constitute legally binding contract between each User and Instapay. By using or otherwise accessing the Site, App and/or Services, each User confirms that it has read, understood and agreed to the Terms.

3.The use of certain Services, or areas or features of the Site, App and/or Services, may be subject to separate policies, standards or guidelines, or may require Users to accept additional terms and conditions as published on the Site.

4.Instapay reserves the right, in its sole discretion, to vary any parts of the Terms any time. Users should periodically visit this page to review the current Terms so that they are aware of any revision by which they are bound. In the event of any changes to the Terms, Instapay will either notify Users via e-mail to their email address registered with Instapay or post the changes on this page and update the “Last Updated” date at the top of this page as the effective date of change. However, any changes will not apply retrospectively. Users’ continued use of the Site, App and/or Services after any such changes constitutes acceptance of the latest Terms.

5.The Terms are also available in the Bahasa Malaysia language. In the event of any inconsistency, conflict, ambiguity or discrepancy between the English version and the Bahasa Malaysia version or any other language version of the Terms, the English version of the Terms shall govern.

1.In the Terms, the following words and expressions have the following meanings unless inconsistent with the context or stated otherwise:

“App” means any and all software applications developed, owned and/or operated by Instapay that run on Mobile Device;

“Applicable Laws” mean and include all statutes, enactments, acts of legislature or parliament, laws, ordinances, rules, bye-laws, regulations, notifications, guidelines, policies, directions, determinations, directives, writs, decrees, injunctions, judgments, awards or orders of any government authority, statutory authority, tribunal, board, court, and if applicable, international treaties and regulations, as amended from time to time;

“Content” means any data, text, software, music, sound, photographs, graphics, video, messages or other materials, including but without limitation to, company logos, trademarks, copyrighted materials and Third Party Resources, displayed, published or made available through the Site / App;

“Intellectual Property Rights” means all intellectual property rights (whether registered or not) including, but not limited to, copyright (including copyright in computer software), patents, logos, trademarks or business names, design rights, database rights, know-how, trade secrets and rights of confidence in connection with the Site, App, Services and/or Content;

“Instapay” means INSTAPAY TECHNOLOGIES SDN BHD (Company No.: 1233660-A), a company incorporated in Malaysia;

“Instapay Technology” means Instapay’s proprietary technology underlying the Site, App and/or Services, including internet operations design, content, software tools, hardware designs, algorithms, software (in source and object forms), source codes, user interface designs, architecture, class libraries, objects and documentation (both printed and electronic), know-how, trade secrets and any related intellectual property rights throughout the world (whether owned by Instapay or its licensors) in connection with the Site, App and/or Services, and also including any derivatives, improvements, enhancements or extensions of the technology conceived, reduced to practice, or developed by Instapay from time to time that are not uniquely applicable to Users or that have general applicability in the art;

“Mobile Device” means a portable and wireless computing or telecommunication device together with accessories including but not limited to smartphone and handheld tablet;

“Parties” means collectively Instapay and a User, and a “Party” means any of them;

“Services” means any and all services provided by Instapay via the Site and/or App or otherwise services provided by Instapay, including but not limited to e-wallet, mobile payment, pre-paid card, remittance and other services as Instapay may introduce from time to time in relation to the Site and/or App;

“Site” means Instapay’s website at https://www.instapaytech.com;

“Terms” means the terms and conditions herein as may be varied or modified from time to time at Instapay’s sole discretion;

“User(s)” means user(s) of the Site, App and/or Services;

“User’s Content” means any data, text, software, music, sound, photographs, graphics, video, messages or other materials, including, but without limitation to, company logos, trademarks and copyrighted materials, that Users post, upload, transmit or otherwise make available through the Site, App and/or Services.

2.References to Clauses are to the clauses herein.

3.The headings are for convenience only and shall not affect the interpretation of the Terms.

4.Unless the context otherwise requires or permits, references to the singular number shall include references to the plural number and vice versa; and words denoting any gender shall include all genders.

5.The expression “person” means any individual, corporation, partnership, association, limited liability company, trust, governmental or quasi-governmental authority or body or other entity or organisation.

1.Users may only use the Site, App and/or Services in compliance with Applicable Laws and for legitimate purposes. Users agree to comply with the Terms, all local rules and laws regarding the use of the Site, App and/or Services, including Users’ online conduct, that are applicable in their jurisdictions.

2.In using the Site, App, Services and/or Content, Users must not:

- use it for any purpose that is improper or unlawful in violation of any Applicable Law or the Terms;

- use it in any manner that could damage, disable or impair Instapay’s server, or interfere with other Users’ access or use of the Site or App and security related feature of the Site or App;

- disassemble, reverse engineer, decompile, modify or otherwise creating derivative works based on Instapay Technology, any software, applications, updates or hardware contained in or available via the Site, App and/or Services;

- do anything or cause an action to be done resulting in the infringement or violation of Instapay’s Intellectual Property Rights;

- attempt to gain unauthorised access to other User’s Account through means of hacking, mining or other means of interference;

- harvest or collect email addresses or other contact information of other Users by electronic or other means for the purposes of sending unsolicited emails or other unsolicited communications;

- interfere with or disrupt the Site or App, or servers or networks connected to the Site or App, or disobey any requirements, procedures, policies or regulations of networks connected to the Site or App, or circumvent any technology used to protect the Site or App;

- obtain or attempt to access or otherwise obtain any materials or information through any means not intentionally made available or provided for through the Site, App and/or Services; and/or

- remove, alter or replace any notices of authorship, trademarks, business names, logos or other designations of origin on the Site or App or pass off or attempt to pass off the Site, App and/or Services as the product of anyone other than Instapay.

3.To the extent where the Site or App allows Users to post, upload, transmit or otherwise make available any User’s Consent, Users represent and warrant that: (i) Users either are the sole and exclusive owner of the User’s Content or have all rights, licenses, consents and releases necessary for use of the User’s Content on the Site or App; and (ii) neither the User’s Content nor Users’ submission, uploading, publishing or otherwise making available of such User’s Content nor Instapay’s use of the User’s Content as permitted herein will infringe, misappropriate or violate a third party’s intellectual property or proprietary rights, or rights of publicity or privacy, or result in the violation of any applicable law or regulation. Users further agree that:

- Users will not share or transmit any material or content that (i) is unlawful, offensive, harmful, threatening, abusive, harassing, tortious, excessively violent, defamatory, vulgar, obscene, pornographic, libelous, invasive of another‘s privacy, hateful racially, ethnically or otherwise objectionable; (ii) they do not have a right to transmit under any law or under contractual or fiduciary relationships; (iii) poses or creates a privacy or security risk to any person; (iv) infringes any intellectual property or other proprietary rights of any party; (v) constitutes unsolicited or unauthorized advertising, promotional materials, commercial activities and/or sales, “junk mail,” “spam,” “chain letters,” “pyramid schemes,” “contests,” “sweepstakes,” or any other form of solicitation; (vi) contains malicious content, software viruses or any other computer code, files or programs designed to interrupt, destroy or limit the functionality of any computer software or hardware or telecommunications equipment; or (vii) is illegal, or intend to promote or commit an illegal act of any kind; or (vii) in Instapay’s opinion, is objectionable or which restricts or inhibits any other person from using or enjoying the Services, or which may expose Instapay or other Users to any harm or liability of any type, or disrepute;

- impersonate any person or entity, or falsely state or otherwise misrepresent Users’ affiliation with a person or entity;

- Instapayis under no obligation to store, retain, publish or make available any User’s Content and that Users shall be responsible for creating backups of any such User’s Content if necessary; and

- under no circumstances shall Instapay be liable in any way for any User’s Content, including, but not limited to, any errors or omissions in any User’s Content, or any loss or damage of any kind incurred in connection with the use of or exposure to such User’s Content made available via the Site or App.

4.Instapay reserves the right to investigate and take appropriate legal action against anyone who, in its opinion, violates the above provisions, and reporting them to the law enforcement authorities.

5.Users are solely responsible for their own hardware, internet connection or telecommunication charges incurred for accessing, connecting to or using the Site, App and/or Services.

- Instapay may modify or upgrade the features and functionality of the Site, App and/or Services from time to time, and reserve the right to make upgrades, updates, modifications and changes as it deems fit. Users understand that such upgrades or changes may result in interruption, modification, failure, delay or discontinuation of the Site, App and/or Services or any function or feature thereof. In this regard, Users acknowledge and agree that Instapay assumes no liability, responsibility or obligation for any such interruption, modification, failure, delay or discontinuation associated with the Site, App and/or Services.

- Notwithstanding anything contained in the Terms, Instapay reserves the right to modify or discontinue, temporarily or permanently, the Site, App and/or Services (or any part thereof). Unless otherwise provided under the applicable terms and conditions, Users agree that Instapay shall not be liable to Users or to any third party for any modification, suspension or discontinuance of the Site, App and/or Services.

- The Site, App, Content and Instapay Technology underlying the Site, App and Services are the property of Instapay and/or its licensors, and are protected by copyright and/or other intellectual property rights. Except as expressly authorised by Instapay, Users agree to not modify, copy, frame, scrape, rent, lease, loan, sell, distribute or create derivative works based on the Site, App and/or Content, in whole or in part. The word “Instapay”, “Instapay Technologies” and associated logos are the trademarks, trade names and/or service marks of Instapay, and Users agree not to display or use in any manner such names and/or marks without Instapay’s prior written authorisation. In using the Site or App, Users shall not engage in or use any data mining, robots, scraping or similar data gathering or extraction methods. Users further acknowledge that they have no right to have access to any aspect of the Site or App in source-code form, and agree not to copy, modify, create a derivative work of, reverse engineer, reverse assemble or otherwise attempt to discover any source code, sell, assign, sublicense, or otherwise transfer any right in Instapay Technology. Any uses of the Site, App and/or Content not expressly permitted herein are prohibited, and any rights thereof not expressly granted herein are reserved by Instapay.

- By using the Site, App and/or Services, Users will not acquire any right, title or interest in or to any of the Intellectual Property Rights of Instapay except for the limited right to use the Site, App and/or Services granted to Users pursuant to the Terms and other applicable terms and conditions. Nothing in the Terms or the Services should be construed as granting, by implication, estoppel, or otherwise, any license or right to use any of Instapay’s trade or service marks displayed on the Site or App without Instapay’s prior written permission in each instance. All goodwill generated from the use of the Site, App, Content and/or Services will inure to Instapay’s exclusive benefit.

- To the extent where Users provide Instapay with any suggestions, comments, improvements, ideas or other feedback (“Feedback”), Users hereby assign ownership of all intellectual property rights subsisting in that Feedback to Instapay and acknowledge that Instapay can use and share such Feedback for any purpose in its sole discretion.

- Other company, product, and service names and logos used and displayed via the Site or App may be trademarks or service marks of their respective owners who may or may not be endorsed by, or affiliated with, or connected to Instapay.

The Site or App may contain links to third party’s websites, products, services, information, advertisement or other materials (“Third Party Resources”) that are not owned or controlled by Instapay, or the Services may be accessible through Third Party Resources. Links to Third Party Resources do not constitute an endorsement or recommendation by Instapay of such Third Party Resources. When Users access Third Party Resources, Users do so at their own risk. Users hereby represent and warrant that they have read and agree to be bound by all applicable policies of any Third Party Resources relating to the use of their services and act in accordance with those policies, in addition to Users’ obligations under the Terms. Instapay has no control over, and assumes no responsibility for, the content, accuracy, privacy policies, or practices of or opinions expressed in any Third Party Resources. In addition, Instapay will not and cannot monitor, verify, censor or edit the content of any Third PartyResources. Users expressly relieve and hold Instspay harmless from any and all liability arising from the use of any Third Party Resources.

1. INSTAPAY PROVIDES THE SITE, APP AND SERVICES ON AN "AS IS" AND "AS AVAILABLE" BASIS. USERS AGREE THAT USE OF THE SITE, APP AND/OR SERVICES IS AT THEIR SOLE RISK.

OTHER THAN WARRANTIES EXPLICITLY PROVIDED UNDER THE APPLICABLE TERMS AND CONDITIONS, INSTAPAY HEREBY DISCLAIMS ALL WARRANTIES OF ANY KIND, INCLUDING, BUT NOT LIMITED TO:

(i) the implied warranties of merchantability;

(ii) fitness for a particular purpose and non-infringement;

(iii) security, reliability, performance and accuracy of the Services; and

(iv) that the Site, App and/or Services will be continuous, uninterrupted and/or error-free.

No advice or information, whether oral or written, obtained from Instapay or through the Site or App will create any warranty not expressly made herein.

2.Instapay assumes no responsibility whatsoever for any arrangements that Users make with any third party as a result of using the Site, App and/or Services.

3.Users may see advertising material submitted by third parties on the Site or App. Each individual advertiser is solely responsible for the content of its advertising material and Instapay assumes no responsibility for the content of such advertising material, including, without limitation, any error, omission or inaccuracy therein.

4.If an User is dissatisfied with the Site, App and/or Services, or does not agree with any part of the Terms, his/her sole recourse is to discontinue use of the Site, App and/or Services.

- UNLESS OTHERWISE PROVIDED IN THE APPLICABLE TERMS AND CONDITIONS, TO THE FULLEST EXTENT PERMITTED BY LAW, IN NO EVENT SHALL INSTAPAY BE LIABLE FOR ANY DIRECT, INDIRECT, INCIDENTAL, SPECIAL, PUNITIVE, EXEMPLARY OR CONSEQUENTIAL DAMAGES OR ANY DAMAGES OR LOSSES OF ANY KIND IN ANY MANNER IN CONNECTION WITH OR ARISING OUT OF THESE TERMS OR THE SITE, APP, SERVICES OR CONTENT, REGARDLESS OF THE FORM OF ACTION OR THE BASIS OF THE CLAIM OR WHETHER OR NOT INSTAPAY HAS BEEN ADVISED OF THE POSSIBILITY OF SUCH DAMAGES, INCLUDING, WITHOUT LIMITATION, DAMAGES FOR LOSS OF PROFITS OR OPPORTUNITY, BUSINESS INTERRUPTION OR ANY OTHER COMMERCIAL DAMAGES OR LOSSES.

- Nothing in the Terms shall limit or exclude:

(i) any other liability that cannot be excluded by law, or

(ii) Users’ statutory rights.

Users hereby agree to indemnify Instapay, including its directors, officers, employees, or agents (“Indemnified Parties”) and keep the Indemnified Parties harmless from and against any claims, actions, suits, proceedings, damages and/or liabilities whatsoever made against the Indemnified Parties arising from

(a) the use of the Site, App, Services and/or Content,

(b) any breach or non-fulfilment of any covenant, agreement or obligation under the Terms,

(c) any violation of the law, or

(d) any violation of the rights of any third party while using the Site, App and/or Services.

The relevant User shall defend and pay all costs, damages, awards, fees (including legal fees on a solicitor and client basis) and judgments awarded against any of the Indemnified Parties arising from such claims, and shall provide Instapay with notice of such claims, full authority to defend, compromise or settle such claims, and reasonable assistance necessary to defend such claims, at that User’s sole expense.

1.The agreement between Instapay and each User under the Terms shall take effect upon the earlier of:

(a) the User’s commencement of the use of the Site, App and/or Services, or

(b) execution of a written agreement with Instapay in respect of the use of the Services,

and will remain in full force and effect for as long as the relevant User continues to use the Site, App and/or Services.

2.Without prejudice to Instapay’s other rights and remedies, Instapay may in its absolute discretion immediately suspend, discontinue or terminate a User’s access to and/or use of the Site, App and/or Services in the event of any actual or suspected breach of any provisions under the Terms, with or without notice at any time, without incurring any liability whatsoever to the User or any third party.In this instance, Instapay reserves the right to remove and discard data in and content of the User’s account maintained with Instapay. Any suspected fraudulent, abusive or illegal activity that may be grounds for such suspension, discontinuance or termination may be referred to the appropriate law enforcement authorities.

3.Upon termination of the agreement with a User pursuant to the Terms, the User’s access rights to the Site, App and/or Services and other rights hereunder or thereunder shall terminate.

4.Upon termination (howsoever occasioned), save for any obligations which are expressed to survive, each Party’s further rights and obligations shall cease immediately, provided that such termination shall not affect a Party’s accrued rights and obligations as at the date of such termination.

- The Terms constitute the entire agreement between the Parties concerning the subject matter herein and supersedes all previous terms and conditions, understanding, representations and warranties relating to that subject matter.

- No delay, neglect or forbearance on the part of Instapay in enforcing against a User any term or condition of the Terms shall either be or deemed to be a waiver or in any way prejudice any right of Instapay under the Terms.

- If any provision of the Terms is prohibited by law or judged by a court to be unlawful, void or unenforceable, the provision shall, to the extent required be severed from the Terms and rendered ineffective as far as possible without modifying the remaining provision of the Terms, and shall not in any way affect any other circumstances of or the validity or enforcement of the Terms.

- Instapay shall not be liable for failures or delays in performing its obligations hereunder arising from any Event of Force Majeure (defined below), and in the event of any such delay, the time for Instapay’s performance shall be extended for a period equal to the time lost by reason of the delay which shall be remedied with all due dispatch in the circumstances. “Event of Force Majeure” means any cause beyond the reasonable control of Instapay, including any act of God, outbreak, or epidemic of any kind, communicable and virulent disease, strike, flood, fire, embargo, boycott, act of terrorism, insurrection, war, explosion, civil disturbance, shortage of gas, fuel or electricity, interruption of transportation, governmental order, unavoidable accident, or shortage of labour or raw materials.

- The Terms and all rights and obligations thereof are not assignable, transferable or sub-licensable by Users without Instapay’s prior written consent. Instapay may transfer, assign or delegate the Terms and its rights and obligations thereof without prior notice to or consent by Users.

- All rights and obligations under the Terms are personal to Users. A person who is not a party to this Terms shall have no right to enforce any provision of the Terms.

Irrespective of the country from which Users access or use the Site, App and/or Services, to the extent permitted by law, the Terms and Users’ use of the Site, App and/or Services shall be governed in accordance with the laws of Malaysia without regard to choice or conflicts of law principles, and Users hereby agree to submit to the exclusive jurisdiction of the courts of Malaysia to resolve any claims or disputes which may arise in connection with the Terms.

1. All notices, requests and/or other communications to be given by Instapay to a User under the Terms may be either by:

- Ordinary mail to a User’s last known address in Instapay’s records;

- Short message service (SMS) or email to a User’s telephone number or email address registered with Instapay;

- Published on the Site or App; and/or

- Published in national daily newspapers in the main languages, circulated generally throughout Malaysia, and shall be deemed notification upon posting/publication.

2. All notices, requests and/or other communications to be given by you to Instapay under this Terms must be communicated to the following address (or to such other address as Instapay may give notice to you from time to time) by hand, registered post or e-mail:

Instapay Technologies Sdn. Bhd.

23A-16, Q Sentral, Jalan Stesen Sentral 2,

Jalan Stesen 2, KL Sentral

50470 Kuala Lumpur

Malaysia

E-mail: connect@instapaytech.com

3. If there are any complaints or inquiries and there is no feedback given by Instapay, you can contact the following bodies:

Bank Negara Malaysia

Laman Informasi Nasihat dan Khidmat (LINK)

Ground Floor, D Block

Jalan Dato' Onn

50480 Kuala Lumpur

Malaysia

Contact Centre (BNMTELELINK)

Tel: 1-300-88-5465

Foreign: 603-2174-1717

Fax: 603-2174-1515

E-mail: bnmtelelink@bnm.gov.my

Ombudsman for Financial Services (664393P)

(formerly known as Financial Mediation Bureau)

14th Floor, Main Block, Menara Takaful Malaysia

No. 4, Jalan Sultan Sulaiman

50000 Kuala Lumpur

Telephone: 03-2272 2811

Fax: 03-2272 1577

Email: enquiry@ofs.org.my

T & C For E Wallet

- Subject to the General Terms of Use and Privacy Policy the terms and conditions set out herein apply to the use of the Service and govern all Users. The provision, operation and use of the Service is further governed by the Applicable Laws. The Service is made available by Instapay at its sole and absolute discretion to enable Users to perform the Transactions.

- By registering an Account to use the Service or otherwise accessing and/or using the Service, you acknowledge that you have read and fully understood these Terms and Conditions prior to using the Service, and hereby agree to unconditionally accept these Terms and Conditions as may be amended by Instapay from time to time. Any person authorised by you to use your Account shall also be bound by these Terms and Conditions. If you do not accept these Terms and Conditions, please do not use or continue to use the Service.

- Subject to the limitations by applicable laws, Instapay reserves the right at its sole and absolute discretion, from time to time, to vary, add to, delete or otherwise amend these Terms and Conditions or any part thereof. In the event of any changes to these Terms and Conditions, Instapay will either notify you 21 days prior via e-mail to your email address registered with Instapay or post the changes on this page and update the “Last Updated” date at the top of this page as the effective date of change. However, any changes will not apply retrospectively. You should periodically visit this page to review the current Terms and Conditions so that you are aware of any revision by which you are bound. Your continued use of the Service after the effective date of any variation, addition, deletion or amendments to these Terms and Conditions shall constitute your unconditional acceptance of such variation, addition, deletion or amendments.

- The use of certain features of the App and/or Service may be subject to additional terms, rules, policies or codes of conduct as determined by from time to time, and you will be required to comply with the same in using them. All such additional terms, rules, policies or codes of conduct are hereby incorporated by reference into these Terms and Conditions.

- Instapay may, at its sole and absolute discretion, provide you with new services from time to time, and these new services will be governed by these Terms and Conditions and the terms and conditions of the relevant new services.

- These Terms and Conditions are also available in the Bahasa Malaysia language. In the event of any inconsistency, conflict, ambiguity or discrepancy between the English version and the Bahasa Malaysia version or any other language version of these Terms and Conditions, the English version of these Terms and Conditions shall govern.

- In these Terms and Conditions, the following words and expressions have the following meanings unless inconsistent with the context or stated otherwise:Account means an electronic wallet account created by or for a User to use the Service.

Account Limit means the maximum amount of money that can be stored in an Account at any point in time being RM5,000.00 only, as the case may be, pursuant to Clauses 4.1 and 4.2 below and as may be revised by from time to time.

Activation means the point in time when an Account is activated for use.

AML/CFT Legislation means the Anti-Money Laundering, Anti-Terrorism Financing and Proceeds of Unlawful Activities Act 2001 of Malaysia.

App means the software application named as “” or such other name as may be determined by from time to time, downloaded onto and run on Mobile Device.

Applicable Laws mean and include all statutes, enactments, acts of legislature or parliament, laws, ordinances, rules, bye-laws, regulations, notifications, guidelines, policies, directions, determinations, directives, writs, decrees, injunctions, judgments, awards or orders of any government authority, statutory authority, tribunal, board, court, and if applicable, international treaties and regulations, as amended from time to time and including but not limited to (a) Financial Services Act 2013, (b) Anti-Money Laundering, Anti-Terrorism Financing and Proceeds of Unlawful Activities Act 2001, (c) Unclaimed Money Act 1965, and (f) the rules, regulations or directives of Bank Negara Malaysia.

Available Balance means the amount of money which is standing in credit in an Account which is available for use by the User of that Account subject to the Account Limit and Daily Transaction Limit.

Authentication or “Authenticated” means a confirmation sent by a User to authorising a particular transaction undertaken or transacted by that User, in accordance with such prescribed method determined by from time to time.

Bank means the authorised bank appointed by Instapay to act as a remittance agent for the Service.

BNM means Bank Negara Malaysia (Central Bank of Malaysia).

Business Day means any day when commercial banks are open for the conduct of business in Malaysia except for Saturdays, Sundays and days which have been gazetted or declared by the government or state government as public holidays in Malaysia.

Customer Service means Instapay’s customer service agent which can be contacted via our phone number +60 3 2786 5301 or email address: connect@instapaytech.com.

Daily Transaction Limit means the daily limit imposed on relevant Transaction in any one (1) calendar day pursuant to Clause 4.5 below.

Intellectual Property Rights means all intellectual property rights (whether registered or not), including but not limited to copyright (including copyright in computer software), patents, logos, trademarks or business names, design rights, database rights, know-how, trade secrets and rights of confidence.

Instapay means Instapay TECHNOLOGIES SDN BHD (Company No.: 1233660-A), a company incorporated in Malaysia.

Instapay Card means the prepaid electronic cash card issued by Instapay.

KYC means Know Your Customer process as determined by Instapay from time to time.

Manual Reload means the feature in the App which allows Users to manually reload their Accounts up to the applicable Account Limit, including but not limited to via (i) debit or credit card, (ii) online banking, (iii) JomPAY, or (iv) any other method which may be determined by Instapay from time to time.

Mobile Device means a portable and wireless computing or telecommunication device together with accessories including but not limited to smartphone and handheld tablet.

Money Transfer means the service which enables Users to transfer money from their Accounts to other Users’ Accounts or other third party accounts, or to receive money into their Accounts from other User’s Accounts or other third party accounts.

Participating Merchants means merchants designated by Instapay to sell goods and/or services by accepting payment via the App.

Parties means collectively Instapay and you, and reference to a “Party” means any of them.

Payment means payment for purchase of goods and/or services (including payment to Participating Merchants) via online websites (e-commerce), mobile applications, static QR code, payment at point-of-sale (POS) terminals, and any other method of payment for goods and/or services.

Personal Data means information that relates directly or indirectly to a User, who is identified or identifiable from that information, including but not limited to name, address, telephone number and other personally identifiable information, collected by Instapay for the provision of the Service.

Platform System means technological system underlying the App used by Instapay to provide the Service.

Privacy Policy means the privacy policy provided by Instapay as published on the App, Site or otherwise presented to you, which sets out how Personal Data of Users will be collected, used and shared.

Reload means the deposit of money into the Account (subject to the Account Limit) via the Reload / Payment Channels to enable Users to use the Service.

Reload / Payment Channels means such channels (including but not limited to the relevant service counters, and Manual Reload) designated by Instapay for Users to make Reload and/or Payment transactions.

Service means the provisions of the Account provided by Instapay via the App which enables Users to perform the Transactions.

Site means Instapay’s website at https://www.instapaytech.com.

Terms and Conditions or Agreement means these terms and conditions for the Service as may be varied or modified from time to time at Instapay’s sole discretion.

Transactions means the transactions performed by a User via the Service including, but not limited to (i) Payment, (ii) Reload, (iii) Money Transfer or (iv) any other service as may be introduced by Instapay from time to time.

Users or you or your means the person who accesses and/or uses the Service, and reference to a “User” means any of them.

- In these Terms and Conditions, the following words and expressions have the following meanings unless inconsistent with the context or stated otherwise:Account means an electronic wallet account created by or for a User to use the Service.

- In these Terms and Conditions, unless the context otherwise requires:

- references to statutory provisions shall be construed as references to those provisions as respectively replaced, amended or re-enacted (whether before or after the date hereof) from time to time and shall include any provisions of which there are re-enactments (whether with or without modification) and any subordinate legislation made under such provision so far as such modification or re-enactment applies or is capable of applying to any transactions entered into pursuant to these Terms and Conditions and (so far as liability thereunder may exist or can arise) shall include also any past statutory provisions or regulations (as from time to time modified or re-enacted) where such provisions or regulations have directly or indirectly replaced;

- clause headings are for convenience only and shall not affect the interpretation of these Terms and Conditions;

- unless the context otherwise requires or permits, references to the singular number shall include references to the plural number and vice versa; and words denoting any gender shall include all genders;

- references to a person (or to a word importing a person) shall be construed so as to include an individual, firm, partnership, trust, joint venture, company, corporation, body corporate, unincorporated body, association, organisation, any government, or state or any agency of a government or state, or any local or municipal authority or other governmental body (whether or not in each case having separate legal personality).

- In order to use the Service, you are required to download the App on your Mobile Device and register for an Account with Instapay in accordance with Instapay’s application process and procedures. If you choose to register for an Account, you agree and consent to providing and maintaining true, accurate, current and complete information or document about you as and when required by Instapay for the purposes of verifying your identity, background and business activities, and providing you the Service. You hereby authorise Instapay to collect, store, retain, process and use Personal Data provided by you to Instapay in accordance with the Privacy Policy, and consent to Instapay conducting KYC or screening your identity and background against third party databases (e.g. CTOS) or other lawful sources. You may choose to decline to provide any information or document as Instapay may request or withdraw your consent to any authorisation, but this may result in Instapay being unable to process or approve your application to register for an Account or to provide you the Service.

- As part of the signing-up process, Instapay may in its sole discretion conduct a standard Customer Due Diligence, gather personal information such as Full name, NRIC no/passport no/other official Identification documentation, Residential and Mailing address, Date of Birth, Nationality, Occupation, Employer name/nature of business, Contact information and Purpose of transaction. Users are required to meet the above Customer Due Diligence standards in order to be eligible for cross-boarder remittance transactions.

- You may only use the Service upon Activation and strictly in accordance with these Terms and Conditions.

- You agree and give consent for Instapay to access your information on IME’s system for the purpose of conducting the Customer Due Diligence when registering for an Account.

- The App and the Service may only be used on your Mobile Device and strictly for your own personal use only as a registered user of the Account. Any instruction, confirmation and/or communication sent from your Mobile Device via your Account shall be deemed to have been sent and/or issued by you irrespective of whether such instruction, confirmation and/or communication was actually sent by you or a third party, whether authorised or otherwise, in which case Instapay shall deem that the Service has been accessed legitimately and the Transactions performed shall be valid. You shall be personally liable and responsible for the use of your Account including but not limited to all transactions undertaken and/or transacted using the Account once the said transaction has been Authenticated irrespective of whether the transactions were undertaken and/or transacted by you unless it can be established that such transactions were erroneously transacted due to an error on the part of Instapay. The record of all Transactions Authenticated through the prescribed method shall be binding and conclusive evidence of your Transactions.

- Instapay reserves all rights to refuse, reject and/or decline any application to register for an Account at its sole and absolute discretion without assigning any reason whatsoever, and Instapay’s decision shall be final, conclusive and cannot be disputed.

- Your Account is not transferable nor assignable to any third party and shall be exclusively used by you. Your Account cannot be pledged or used in any manner by you as any form of security instrument for any purpose whatsoever.

- Subject to your continued compliance with these Terms and Conditions, Instapay grants to you a limited, revocable, non-exclusive, non-transferable right to use the App solely for your personal, non-commercial purpose and in compliance with these Terms and Conditions. All rights not expressly granted to you pursuant to these Terms and Conditions are reserved by Instapay, and all uses of the App and the Service not expressly permitted hereunder are prohibited.

- You will be assigned the following product upon successful registration:

Product Registration Method Instapay Account Self-registration – Download the mobile application and upload the required documents Face to Face Registration – Meeting with Instapay Representative and submission of the completed Application Form along with the required documents - Your Account Limit is as follows:

Product Registration Method Instapay Account RM10,000 (Ringgit Malaysia Ten thousand) - you must meet the qualification criteria and KYC requirements determined by Instapay from time to time. (Note: Certain App features may be activated only for customers who have a face to face meeting with Instapay Representative) - You should regularly review the stored fund in your Account as you shall only be able to store such amount of fund in your Account up to the applicable Account Limit. In the event the amount of fund in your Account has reached the Account Limit, you shall not be able to receive further in-coming fund into your Account in excess of the Account Limit until the stored fund is reduced below the Account Limit by use, withdrawal or transfer. Any in-coming fund in excess of the Account Limit will be withheld by Instapay for a maximum period of thirty (30) days until such fund can be credited into your Account within the available Account Limit but any remaining balance uncredited to your Account due to unavailable Account Limit will be refunded to the transferor or payor of such fund.

- You will be assigned the following product upon successful registration:

- When your Available Balance fall below your Account Limit, you may Reload your Account via Reload / Payment Channels or Manual Reload up to your Account Limit. By linking your credit and/or debit card to your Account, you shall be solely responsible and liable for all Reload(s) that may occur.

- You can make Payment and Money Transfer subject to the applicable Daily Transaction Limit. Please refer to Product FAQ on www.instapaytech.com for transaction limits applicable to you.

- The following are the functionalities for the wallet account:

Account Functionality Instapay Account Purchase Transactions Yes Funding from Personal Bank Account Yes Transfer to Own Bank Account Yes Prepaid Card Yes* Wallet Limit RM10,000 *Prepaid Card will be issued with a minimum reload of RM100 to the wallet or as determined by Instapay

- The following are the functionalities for the wallet account:

- The imposition of Account Limit and Daily Transaction Limit is to avoid any fraudulent, illegal or unlawful transactions including but not limited to breaches of regulation and guidelines under the Financial Services Act 2013 and AML/CFT Legislation.

- The Transactions performed may not always be simultaneous with any instructions given at any time. Although the Account and/or Service is accessible outside any Business Days, certain instructions may only be processed on a Business Day.

- You may view your transaction history for the previous thirty (30) days via the App. You should regularly review your transaction history to ensure that there has not been any unauthorised use of the Service performed via your Account. A hardcopy of the transaction history is available upon request with Instapay subject to payment of any applicable fee chargeable for such request. All entries in the transaction history are deemed true and accurate unless you inform Instapay of any error, exception, dispute or unauthorised transaction within thirty (30) days from the date of the transaction. If Instapay does not receive any written notification from you concerning any error in the transaction history within the stipulated time frame, the transaction history shall be deemed true, complete and accurate, and you shall then be deemed to have accepted the entries in the transaction history made up to the date of the last entry in the transaction history as final and conclusive.

- By registering for the Account, you authorise Instapay to rely and act upon all communications and instructions given by you in relation to the use of the Service. An instruction will only be accepted by Instapay if you have satisfied the prescribed security criteria as determined by Instapay from time to time. In giving instruction to Instapay or through the Service, you ensure that any and all instructions are accurate and complete, failing which Instapay shall not liable for any losses or damages in relation thereto.

- Notwithstanding anything contained in these Terms and Conditions, Instapay may reject any of your instructions relating to the use of the Service or any Transaction, if:-

(a)the Service or Transaction is in breach of any of provisions of these Terms and Conditions; or

(a)Instapay suspects the instructions may be fraudulently issued or determines that the use of the Service or Transaction poses a risk to the Platform System.

- Notwithstanding anything contained in these Terms and Conditions, Instapay may reject any of your instructions relating to the use of the Service or any Transaction, if:-

- You shall not be entitled to receive any interest or other profits in anyway whatsoever in relation to the Service.

- In using the Service, you shall:

(a)download and install the official App from the Google Playstore and/or Apple iOS store only and not from any other sources, failing which you shall be sole responsible for any losses or damages in relation thereto, including but not limited to any financial and/or information loss;

(b)be responsible for all equipment necessary to use the Service and App (including ensuring compatibility of your Mobile Device with the Platform System and any changes or upgrades thereof). If you download and install the App onto any illegally modified devices such as jailbroken device, rooted device or any device that has been altered in any way whatsoever, you shall be sole responsible for any losses or damages in relation thereto, including but not limited to any financial and/or information loss;

(c)keep your information related to your Accounts, including Personal Data, password and login information, confidential at all times and shall take all steps to prevent disclosure of such information and unauthorised access or use of your Account. You shall be solely responsible and liable for any use and misuse of your Account and all activities that occur under your Account;

(d)ensure that all information and data provided to Instapay including Personal Data are true, accurate, updated and complete at all times, and promptly update such information and data if there are any changes to the same. Instapay shall not be responsible and liable whatsoever and howsoever to you due to any inaccurate or incomplete information and data provided to Instapay;

(e)comply with all notices or instructions given by Instapay from time to time in relation to the use of the Service and App;

(f)be responsible and liable for all usage of and all payment of the fees, charges, taxes and duties for using the Services, including but not limited to payment of all fee, charges, taxes and duties for the purchase of products and/or services to third parties including Participating Merchants in a timely manner;

(g)be fully responsible for any and all data transmitted or broadcasted from your Mobile Device whether by you or any other person;

(h)comply with all Applicable Laws relating to the Service;

(i)take all reasonable steps to prevent fraudulent, improper or illegal use of the Service;

(j)exercise all due care and diligence in the use and maintenance of the Account and Service;

(k)cease to utilise the Service or any part thereof for such period as may be required by Instapay;

(l)report immediately to Instapay, including lodging a police report and providing a certified true copy thereof whenever required by Instapay, upon the discovery of any fraud, theft, loss, unauthorised usage or any other occurrence of unlawful acts in relation to the Mobile Device and its use. Prior to Instapay’s receipt of your notice or instruction to suspend or terminate the Account and/or Service, you shall be liable for all transactions made and/or charges incurred in respect of the fraudulent, improper or illegal use of your Account and/or Service and/or arising from the theft or loss of your Mobile Device.

- In using the Service, you shall not:

(a)fraudulently register an Account. If Instapay discovers that you are impersonating another person, Instapay shall be entitled to immediately terminate your Account and report such fraudulent activity to the relevant authorities;

(b)use the Service for any purpose which is against public interest, public order or national harmony or for any unlawful purposes, including but not limited to vice, gambling or other criminal purposes whatsoever or transmitting any content which is offensive on moral, religious, communal or political grounds, or is abusive, defamatory or of an indecent, obscene or menacing character or in any other manner which may result in complaints, claims, disputes, penalties or liabilities to Instapay;

(c)use the Service and/or the App to cause embarrassment, distress, annoyance, irritation, harassment, inconvenience, anxiety or nuisance to any person;

(d)hack into, access, tamper, breach or circumvent any authentication or security of any host, network or account of Instapay or its provider’s computer systems or interfere with service to any user, host or network, including, without limitation, sending a virus and causing excessive or disproportionate load on the Platform System;

(e)attempt to probe, scan or test the vulnerability of the Platform System or network or breach any security or authentication measures;

(f)copy, disclose, modify, reformat, display, distribute, license, transmit, sell, perform, publish, transfer and/or otherwise make available any of the Service or any information obtained by you while using the Service or while accessing the App;

(g)remove, change and/or obscure in any way anything on the App and/or the Service or otherwise use any material obtained whilst using the App and/or the Service except as set out in these Terms and Conditions;

(h)copy or use any material from the App and/or the Service for any commercial purpose, remove, obscure or change any copyright, trade mark or other intellectual property right notices contained in the original material, or from any material copied or printed off from the App, or obtained as a result of the Service;

(i)use any of Instapay’s trademarks, logo, URL or product name without Instapay’s written consent;

(j)attempt to decipher, decompile, disassemble or reverse engineer any of the software used to provide the Service;

(k)impersonate or misrepresent your affiliation with any person;

(l)attempt to receive funds from Instapay and/or any Participating Merchant or other third party for the same transaction by submitting similar claims;

(m)use an anonymizing proxy while registering an Account;

(n)control an Account that is linked in any way to another Account that has or suspected to be engaged in any prohibited or restricted activities under these Terms and Conditions;

(o)manipulate or exploit Instapay’s promotional campaigns or activities or other Service in anyway which Instapay may deem as improper, irregular or dishonest;

(p)use the Service dishonestly or in bad faith or with malicious intent.

- Instapay reserves the right to make any alteration or changes to the App and/or Service or any part thereof, or suspend or terminate the App and/or Service or any part thereof, without prior notice, in which event Instapay shall not be liable for any loss or inconvenience to you or any third party resulting therefrom except where the App and/or Service shall be permanently terminated any Available Balance shall be returned to you.

- Unless otherwise notified by you, you agree that Instapay may send you notifications relating to promotional and marketing activities from time to time. You may opt out from receiving any promotional or marketing messages from Instapay by unsubscribing via email or contacting Customer Service.

- Instapay may run campaigns, contests or promotions in relation to the Service as may be notified to you from time to time. You agree that your participation in such campaigns, contests or promotions shall be subject to the specific terms and conditions thereof.

- Instapay may request for additional information or documentation from you for the purposes of verifying your identity or providing you the Service. You agree that you will provide such information and/or documentation promptly to Instapay upon request.

- Notwithstanding anything in these Terms and Conditions, Instapay may immediately change the procedures or mode of operation of the Service without giving any reason or notice to you.

- You acknowledge that the App, Platform System and Service and all Intellectual Property Rights in relation thereto belong to Instapay or its licensors. All rights are expressly reserved.

- Notwithstanding any provisions therein, nothing on the App and/or the Service shall be construed as conferring any license or other transfer of rights to you of any intellectual property or other proprietary rights of Instapay, other than the limited right to use the App and/or Service in accordance with these Terms and Conditions.

- You agree that by registering an Account or otherwise using the Service, you are giving consent to Instapay that your Personal Data collected by Instapay from you will be used and/or disclosed in accordance with the Privacy Policy.

- Instapay may monitor and record all Transactions and communications that may take place between you and Instapay for Instapay's business purposes (including but not limited to quality control and training, prevention of unauthorised use of Instapay's telecommunication systems, ensuring effective systems operation and prevention and detection of crime).

- You agree and consent that Instapay may extract or use any Personal Data or any other data from your Account which may be required as evidence in court and/or to provide to relevant enforcement authorities when necessary in the event of a suspected and or proven misuse of the Service. Your agreement and consent under this Clause shall survive the termination of your Account or your discontinuance of use of the Service.

- Instapay reserves the right to impose any charges or fees for the use of the Service or certain features of the Service. If such charges or fees are required, you will be able to review and accept them, including related terms and conditions, before making payment.

- Instapay reserves the right to revise any charges or fees applicable to the Service from time to time in its sole and absolute discretion provided, however, that such revision shall not apply to Users who have already purchased a paid feature or are having an on-going paid subscription. Any such revision will be communicated to Users in advance via e-mail or published on the App (which you will have an opportunity to review it before making payment) and will take effect from the time the price change is communicated to you or published on the App.

- If any supply of services under these Terms and Conditions is taxable in accordance with the laws of Malaysia (including but not limited to Sales and Services Tax, Goods and Services Tax, etc), then Instapay reserves the right to levy such tax(es) at the prescribed rate and you agree to pay the amount of such tax(es).

- In accessing and using the App and/or Service, you shall be solely responsible and liable for all charges and payment due to your communication service provider to access the App and/or Services, including but not limited to telephone charges and internet/data charges.

- You shall also be solely responsible and liable for any fees raised by third parties, including but not limited to card issuers or banks, relating to use of the Service. Instapay reserves the right to decline acceptance of payment instruments, such as credit cards, debit cards or bank accounts, as funding methods at its sole and absolute discretion.

- You are fully responsible for all products and services purchased when you make any payment through your Account or anytime when you authorise and Authenticate amounts to be deducted from your Account. You shall be fully responsible for ensuring that the transaction amount is correct.

- Instapay shall not be responsible to settle any dispute that you may have with any merchant for the goods or services purchased by you using the Service. You shall be responsible to contact the respective merchants for a refund for products or services purchased from them. Instapay shall not be a party to such dispute nor shall Instapay be liable such dispute in any way.

- In the event any merchant may provide a refund option in relation to the payment for any purchase of goods and/or services in accordance with its after-sale service policy, such refund shall be subject to the following:

(a) the refund process shall be subject to the merchant’s refund policy and any terms and conditions imposed on such refund;

(b) your Account must be active at the time of refund process; and

(c) in the event your Account Balance shall exceed the applicable Account Limit after the completion of the refund process, the refund process will automatically fail. You will then be required to request for a different refund method or process from the merchant.

- If you discover any error or discrepancy in your Account, you must contact Customer Service within thirty (30) days from the date of the disputed transaction, failing which you shall be deemed to have accepted the accuracy of your Transaction.

If it is revealed in the course of Instapay’s investigation that the disputed Transaction was indeed made in error, Instapay will refund the disputed sum directly to your Account upon completion of the investigation which will not exceed thirty (30) days from your complaint.

However, Instapay reserves the right to not refund any disputed amount to you if Instapay believes in good faith that you have acted contrary to these Term and Conditions.

In the event the investigations and verifications conducted by Instapay reveal that the disputed Transaction(s) was accurate, genuine and properly authorised by you, then you shall be liable for such disputed Transaction(s).

In the event the investigations and verifications conducted by Instapay reveal that the disputed Transaction(s) was not genuine, dishonest, fraudulent or an abuse of process, you shall indemnify Instapay against all costs and expenses incurred by Instapay in the course of carrying out the investigations or verifications.

Instapay’s findings in any investigation conducted in relation to your Account shall be conclusive, final and binding on you and shall not be questioned or disputed.

- If you discover any error or discrepancy in your Account, you must contact Customer Service within thirty (30) days from the date of the disputed transaction, failing which you shall be deemed to have accepted the accuracy of your Transaction.

- Notwithstanding the above, any refund by Instapay shall not, in and of itself, amount to completion of the investigation.

Instapay may refund such sum to your Account based on preliminary investigation results.

Upon the completion of full investigation, if it is discovered that you are not entitled to the refund, Instapay may, at its sole and absolute discretion, either adjust your Account and deduct the refunded sum from your Account or claim such sum from you.

- Notwithstanding the above, any refund by Instapay shall not, in and of itself, amount to completion of the investigation.

- You agree and consent to the use by Instapay and/or its personnel or advisors of any information related to you or the particulars of the relevant Transaction(s) or your Account for the purpose of investigating any claim or dispute arising out of or in connection with the disputed Transaction(s).

You further agree that in the event of a dispute or claim of any nature arising in respect of any Transaction, the records of the Transaction(s) generated by Instapay shall be used as a reference and shall be the sole basis of settling such dispute or claim.

Your agreement and consent under this Clause shall survive the termination of your Account or your discontinuance of use of the Service.

- Instapay and its officers shall comply in all material respects with all Applicable Laws governing the Service.

- Instapay acknowledges that the document or information collected by Instapay relating to your affairs or Account as a customer of Instapay will be only used and/or disclosed in accordance with the secrecy provisions under the Financial Services Act 2013.

- Without limiting the generality of the foregoing, to the extent required by the AML/CFT Legislation, Instapay shall

(i) maintain an anti-money laundering and anti-terrorism financing compliance program that is in compliance, in all material respects, with the AML/CFT Legislation,

(ii) conduct, in all material respects, the due diligence required under the AML/CFT Legislation in connection with the use of the Accounts, including with respect to the origin of the funds used by Users to Reload their Accounts, and

(iii) maintain sufficient information to identify you for purposes of compliance, in all material respects, with the AML/CFT Legislation.

- You may, at any time, terminate use of the Service or your Account by giving notice of such termination by contacting Customer Service.

Subject to Clause 12.4 below, if you have any Available Balance in the Account, you must ensure that you provide to Instapay the correct bank account details and any other information as may be required by Instapay to enable Instapay to process the termination of your Account and refund the Available Balance to your bank account within twelve (12) Business Days provided that all transactions with any relevant third parties (e.g. merchants) having been first settled.

If you do not have any Available Balance in your Account, your Account shall be deemed terminated immediately upon receipt of your termination notice by Instapay.

Instapay shall not be liable for any losses or damages suffered by you due to any incorrect banking information provided by you.

Any refund to a foreign bank account shall be subject to the prevailing foreign exchange transfer rate of the Bank or the relevant foreign bank and any other charges which may be imposed by the Bank, the relevant foreign bank, and/or incurred in effecting the refund.

- You may, at any time, terminate use of the Service or your Account by giving notice of such termination by contacting Customer Service.

- Without prejudice to its other rights and remedies, Instapay shall be entitled to immediately suspend or terminate your use of the App or Service (or any part thereof) and your access to your Account, with or without any notice to you, upon the occurrence of any of the following events:

(a) if in the opinion of Instapay, there is dishonesty, suspected fraud, illegality, criminality or misrepresentation in the conduct of your Account or your use of the Service;

(b) if you are in breach of, or Instapay has reasonable grounds to believe that you have breached, any of the provisions of these Terms and Conditions, the terms and conditions of the General Terms of Use and/or any applicable terms and conditions of any new services as may be provided by Instapay from time to time, or have engaged in any conduct prejudicial to Instapay or, if in the opinion of Instapay, your acts are prejudicial to Instapay’s interests;

(c) if it has come to Instapay’s attention of any irregular, suspicious or unauthorized activity on your Account;

(d) if you are in breach of any Applicable Law;

(e) if you have submitted false documents or have declared false information during your application for the Service;

(f) if any information provided by you is untrue, inaccurate, not current or incomplete in the course of using the Service;

(g) if you have acted in bad faith or with malicious intent in using the App and/or Service;

(h) if your name is listed under any regulatory watchlist (including but not limited to listing related to terrorism and terrorism financing under the AML/CFT Legislation);

(i) if you fail to provide any additional information which Instapay may request from you from time to time in accordance with these Terms and Conditions; and/or

(j) where Instapay has reserved such right to suspend and/or terminate your Account under any other provisions of these Terms and Conditions.

- Without prejudice to its other rights and remedies, Instapay shall be entitled to immediately suspend or terminate your use of the App or Service (or any part thereof) and your access to your Account, with or without any notice to you, upon the occurrence of any of the following events:

- If your Account is terminated by Instapay pursuant to Clause 12.2 above, Instapay shall not be obliged to refund the Available Balance (if any) to you until and unless clearance has been obtained from the relevant authorities, if applicable.

Instapay reserves the right to take any action against you as may be deemed necessary or as may be required under Applicable Laws or by the relevant authorities.

- If your Account is terminated by Instapay pursuant to Clause 12.2 above, Instapay shall not be obliged to refund the Available Balance (if any) to you until and unless clearance has been obtained from the relevant authorities, if applicable.

- In the event your Account is ceased, terminated or suspended by Instapay due to fraudulent, illegal or unlawful transactions including but not limited to breaches of any Applicable Law, you shall not be entitled to obtain any refund of the monies and all reload monies whatsoever in your Account and it shall be lawful for Instapay to retain such monies for an indefinite period or release them to the relevant authorities in accordance with Applicable Laws.

You shall not be entitled to claim any form of compensation for any loss arising therefrom from Instapay.

- In the event your Account is ceased, terminated or suspended by Instapay due to fraudulent, illegal or unlawful transactions including but not limited to breaches of any Applicable Law, you shall not be entitled to obtain any refund of the monies and all reload monies whatsoever in your Account and it shall be lawful for Instapay to retain such monies for an indefinite period or release them to the relevant authorities in accordance with Applicable Laws.

- Upon termination of your Account (howsoever occasioned), save for any obligations which are expressed to survive, each Party’s further rights and obligations shall cease immediately, provided that such termination shall not affect a Party’s accrued rights and obligations as at the date of such termination.

- If Instapay detected unusual, irregular, suspicious, unauthorised or fraudulent activity on your Account, Instapay may suspend and/or terminate the Account immediately as security or precautionary measures (with or without prior notice to you) until Instapay has verified the activity accordingly.

If Instapay decides to suspend and/or terminate the Account, Instapay will attempt to notify you via phone or electronic mail or any other means of communication.

You agree not to use or attempt to use a suspended, terminated or otherwise invalid Account.

Such action taken by Instapay will not affect your rights and obligations pursuant to these Terms and Conditions.

If Instapay has terminated your Account through no fault of yours, you will be entitled to a refund of any Available Balance as provided in these Terms and Conditions.

- If you do not log in to your Account for more than six (6) months, and there is no Available Balance in your Account, Instapay may in its sole and absolute discretion treat your Account as dormant and may suspend your Account.

- If you key in the wrong credentials as required, it may result in your access to the App being suspended. To reactivate your access to the App, you can reactivate via the “Forgot Password” button.

- If your Account is suspended for any reason, you should contact Customer Service to reactivate your Account. Instapay may reactivate your Account at its sole and absolute discretion and subject to Instapay’s prevailing policies and procedures.

- Instapay PROVIDES THE APP, PLATFORM SYSTEM AND SERVICE ON AN "AS IS" AND "AS AVAILABLE" BASIS. USERS AGREE THAT USE OF THE APP, PLATFORM SYSTEM AND SERVICE IS AT THEIR SOLE RISK. OTHER THAN WARRANTIES EXPLICITLY PROVIDED UNDER THESE TERMS AND CONDITIONS, Instapay HEREBY DISCLAIMS ALL WARRANTIES OF ANY KIND, INCLUDING, BUT NOT LIMITED TO,

(I) THE IMPLIED WARRANTIES OF MERCHANTABILITY,

(II) FITNESS FOR A PARTICULAR PURPOSE AND NON-INFRINGEMENT,

(III) SECURITY, RELIABILITY, PERFORMANCE AND ACCURACY OF THE SERVICES, AND

(IV) THAT THE APP, PLATFORM SYSTEM AND SERVICE WILL BE CONTINUOUS, UNINTERRUPTED AND/OR ERROR-FREE. NO ADVICE OR INFORMATION, WHETHER ORAL OR WRITTEN, OBTAINED FROM Instapay OR THROUGH THE APP, PLATFORM SYSTEM AND SERVICE WILL CREATE ANY WARRANTY NOT EXPRESSLY MADE HEREIN.

- Instapay PROVIDES THE APP, PLATFORM SYSTEM AND SERVICE ON AN "AS IS" AND "AS AVAILABLE" BASIS. USERS AGREE THAT USE OF THE APP, PLATFORM SYSTEM AND SERVICE IS AT THEIR SOLE RISK. OTHER THAN WARRANTIES EXPLICITLY PROVIDED UNDER THESE TERMS AND CONDITIONS, Instapay HEREBY DISCLAIMS ALL WARRANTIES OF ANY KIND, INCLUDING, BUT NOT LIMITED TO,

- You shall be solely responsible for any and all consequences of use or misuse of your Account, login credentials, and/or security credentials. You shall be responsible for all losses and payments (including the amount of any transaction carried out without your authority) due to your negligence or where you have acted fraudulently. For the purposes of this Clause, negligence shall be deemed to include failure to observe any of your security duties referred to in these Terms and Conditions.

- However, you will not be liable for any losses caused by system glitches, technical error or other operational issues encountered at Instapay, merchants or other relevant parties involved in the provision of the Service.

- You acknowledge that Instapay may use third party suppliers to provide hardware, software, networking, connectivity, storage, payment gateway or processing and other technology in order to provide the App, Platform System and/or Service. The acts and omissions of those third party suppliers may be outside of Instapay’s control, and Instapay does not accept any liability for any loss or damage suffered as a result of any act or omission of any third party supplier.

- Instapay has no responsibility whatsoever for any arrangements you make with any third party (including merchants, third parties or other Users) as a result of your use of the Service. You should conduct whatever investigation you feel necessary or appropriate before proceeding with any online or offline transaction with any of these third parties. In the event that you have a dispute with one or more other Users or third parties, you hereby release Instapay and its affiliates (and its officers, directors, agents, subsidiaries, joint ventures and employees and those of its affiliates) from claims, demands, and damages (actual and consequential) of every kind or nature, known or unknown, suspected or unsuspected, disclosed or undisclosed, arising out of or in any way related to such dispute.

- Instapay shall not be liable or responsible to you and/or to any other third parties for any costs, loss or damages (whether direct or indirect), or for loss of revenue, loss of profits or any consequential loss whatsoever as a result of your usage of the Service including but not limited to:-

(a)your Account being hacked and/or theft of your login credentials and/or security credentials; and

(b)any resulting dispute between you and Participating Merchants or third parties over any issue, including but not limited to, issues relating to quality, merchantability, fitness for use, quantity or delivery.

- Instapay shall not be liable or responsible to you and/or to any other third parties for any costs, loss or damages (whether direct or indirect), or for loss of revenue, loss of profits or any consequential loss whatsoever as a result of your usage of the Service including but not limited to:-

- If you are dissatisfied with the App and/or Service, or do not agree with any part of these Terms and Conditions, your sole recourse is to discontinue use of the App and/or Service.

- TO THE FULLEST EXTENT PERMITTED BY LAW, IN NO EVENT SHALL Instapay BE LIABLE FOR ANY DIRECT, INDIRECT, INCIDENTAL, SPECIAL, PUNITIVE, EXEMPLARY OR CONSEQUENTIAL DAMAGES OR ANY DAMAGES OR LOSSES OF ANY KIND IN ANY MANNER IN CONNECTION WITH OR ARISING OUT OF THESE TERMS AND CONDITIONS OR THE USE OF THE APP, PLATFORM SYSTEM OR SERVICE, REGARDLESS OF THE FORM OF ACTION OR THE BASIS OF THE CLAIM OR WHETHER OR NOT Instapay HAS BEEN ADVISED OF THE POSSIBILITY OF SUCH DAMAGES, INCLUDING, WITHOUT LIMITATION, DAMAGES FOR LOSS OF PROFITS OR OPPORTUNITY, BUSINESS INTERRUPTION OR ANY OTHER COMMERCIAL DAMAGES OR LOSSES. IN THE EVENT THAT APPLICABLE LAW DOES NOT ALLOW THE EXCLUSION OF WARRANTIES STATED HEREIN OR THE LIMITATION OF LIABILITY STATED HEREIN, YOU HEREBY EXPRESSLY AGREE THAT IN NO EVENT WILL Instapay’S LIABILITY FOR ANY CLAIM OR DAMAGES HEREUNDER EXCEED THE AGGREGATE AMOUNT OF RINGGIT MALAYSIA FIVE THOUSAND OR AN AMOUNT EQUIVALENT TO YOUR ACCOUNT LIMIT, WHICHEVER IS LESSER.

- Nothing in these Terms and Conditions excludes, restricts or modifies any statutory rights that you may have under Applicable Laws that cannot be excluded, restricted or modified.

- You hereby agree to indemnify Instapay and its affiliates (and its officers, directors, agents, subsidiaries, joint ventures and employees and those of its affiliates) (“Indemnified Parties”) and keep harmless the Indemnified Parties from and against any claims, actions, suits, proceedings, damages and/or liabilities whatsoever made against the Indemnified Parties arising from your use of the App, Platform System and/or Services and/or your non-performance or violation of your duties and obligations under these Terms and Conditions or any Applicable Law. You shall defend and pay all costs, damages, awards, fees (including legal fees on a solicitor and client basis) and judgments awarded against any of the Indemnified Parties arising from such claims, and shall provide Instapay with notice of such claims, full authority to defend, compromise or settle such claims, and reasonable assistance necessary to defend such claims, at your sole expense.

- You hereby agree that if Instapay initiates legal proceedings against you because of a default under these Terms and Conditions, you shall be liable to indemnify Instapay all legal costs (including costs on a solicitor and client basis), other costs, charges and expenses which Instapay may incur in enforcing or seeking to enforce any of the provisions of these Terms and Conditions or in obtaining or seeking to obtain payment of all or any part of the monies owing by you. However, your responsibility for such fees and costs shall not exceed the maximum amount allowed by law.

- Without limiting the generality of any provision in these Terms and Conditions, Instapay shall not be liable for any failure to perform its obligations herein caused by an act of God, insurrection or civil disorder, military operations or act of terrorism, all emergency, acts or omission of Government, or any competent authority, labour trouble or industrial disputes of any kind, fire, lightning, subsidence, explosion, floods, acts or omission of persons or bodies for whom Instapay has no control over or any cause outside Instapay’s reasonable control.

- The Service may occasionally be affected by interference caused by causes or objects beyond Instapay’s control such as buildings, underpasses and weather conditions, electromagnetic interference, equipment failure or congestion in the Platform System. In the event of such interference, Instapay shall not be responsible for any inability to use or access the Service, or interruption or disruption of the Service.

- These Terms and Conditions constitute the entire agreement between the Parties concerning the subject matter herein and supersedes all previous terms and conditions, understanding, representations and warranties relating to that subject matter.

- No delay, neglect or forbearance on the part of Instapay in enforcing against you any provision of these Terms and Conditions shall either be or deemed to be a waiver or in any way prejudice any right of Instapay hereunder.

- If any provision of these Terms and Conditions is prohibited by law or judged by a court to be unlawful, void or unenforceable, the provision shall, to the extent required be severed from these Terms and Conditions and rendered ineffective as far as possible without modifying the remaining provision of these Terms and Conditions, and shall not in any way affect any other circumstances of or the validity or enforcement of these Terms and Conditions.

- These Terms and Conditions and all rights and obligations thereof are not assignable, transferable or sub-licensable by you without Instapay’s prior written consent. Instapay may transfer, assign or delegate these Terms and Conditions and its rights and obligations thereof without prior notice to or consent by you.

- All rights and obligations under these Terms and Conditions are personal to you. A person who is not a party to these Terms and Conditions shall have no right to enforce any provision of these Terms and Conditions.

Irrespective of the country from which you access or use the App, Platform System and/or Service, to the extent permitted by law, these Terms and Conditions and your use of the App, Platform System and/or Service shall be governed in accordance with the laws of Malaysia without regard to choice or conflicts of law principles, and you hereby agree to submit to the exclusive jurisdiction of the courts of Malaysia to resolve any claims or disputes which may arise in connection with these Terms and Conditions.

- All notices, requests and/or other communications to be given by Instapay to a User under these Terms and Conditions may be either by:

- ordinary mail to your last known address in Instapay’s records;

- short message service (SMS) or email to your telephone number or email address registered with Instapay;

- published on the App or Site; and/or

- published in national daily newspapers in the main languages, circulated generally throughout Malaysia, and shall be deemed notification upon posting/publication.